US chip bill takes a successful step

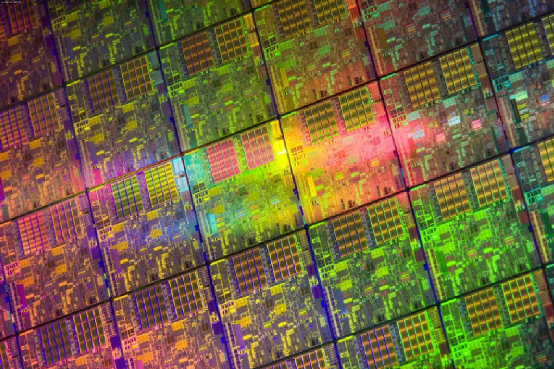

ET Wednesday, the U.S. Senate finally approved a chip bill aimed at boosting U.S. competitiveness in semiconductors and cutting-edge technology.

The Senate approved the long-delayed measure by a 64-33 vote on the same day, and House Majority Leader Hoyer said the House would vote on the bill on Thursday.

According to reports, the bill, called "CHIPS-plus," will provide the semiconductor industry with about $52 billion in grants and other incentives, as well as a 25 percent tax break for companies setting up factories in the United States, which is expected to reach $24 billion. .

The bill would also allocate more than $170 billion over the next five years to the National Science Foundation, the U.S. Department of Commerce, and the National Institute of Standards and Technology to increase spending on U.S. research, although Congress must pass a A separate grant proposal to fund these investments.

If the "Act" is passed in the Senate and Senate, the U.S. government will allocate $54 billion over the next five years for research and production of chips and 5G equipment. The concern is that, like many previous proposals by the U.S. government, the "Chip Act" also sets up a "guardrail" in China. The bill clearly states that U.S. semiconductor companies are prohibited from investing in China or "other threatening countries" for the next ten years. (Original source: Financial Associated Press editor: Niu Zhanlin, China Youth Daily reporter: Hu Wenli)

The US chip bill is closely related to China not in its investment plan to revitalize local semiconductors, but in its restriction of US capital's investment in China's semiconductor industry. Zhang Jiwen, the author of "Investment World", explained in "A Chip Company Falls in Round B" that today's semiconductor investment industry has shown a decline: domestic capital has begun to shrink with the country's economic downturn, and foreign capital that can give these companies hope is withdrawing. ... Although China's semiconductor industry is blooming fast, it can be said that hundreds of flowers bloom in a short time, but it is difficult to say whether it can persevere in the harsh market environment.

Huawei officially releases Hongmeng OS 3

Huawei officially released HarmonyOS 3 (HarmonyOS 3) on July 27, and carried out a series of upgrades on the original basis, and expanded it to more devices and more application fields, providing users with more smart and new experience.

HarmonyOS 3 is a brand-new privacy center, which can record and count users' usage rights in real time, including cameras, microphones, etc., and can also provide users with sensitive behaviors, so as to provide users with privacy protection suggestions.

At the same time, HarmonyOS 3's hyperterminal connectivity has been further improved, it can support 12 different devices, including mobile phones, tablets, smart screens, speakers, headphones, watches, ink tablets, monitors, printers, smart glasses, cars 12 different terminals such as machine. When various devices are combined into a hyperterminal, the interconnection and cooperation between the devices can be made to give full play to their respective advantages.

In addition, HarmonyOS 3 comprehensively upgrades the system architecture, improves the system's basic memory, file system, task scheduling and other functions, and greatly improves the system performance of HarmonyOS 3 through multi-level scheduling optimization. (Original source: Bubble Network)

The appearance of Huawei Hongmeng OS 3 proves that the Huawei Hongmeng project is still advancing steadily. Whether it is the departure of the "Father of Hongmeng" or Huawei's turn to the automotive battlefield, it seems that it has not had much impact on the Hongmeng system. In addition to continuing to improve the privacy and security, system scheduling and performance that Huawei is proud of this time, the author believes that the key point is that the "Internet of Everything" function of Hongmeng OS 3 has been upgraded again. The Internet of Things has successfully joined Huawei Internet of Everything. Then, in the future, Huawei's further expansion of its system ecosystem is an important step in the future. At the same time, we also learned that Xiaomi has built its own smart home ecosystem and founded Mijia. If Xiaomi succeeds in building a car, it will be an important opponent of Huawei.

The Fed really raises interest rates by 75 basis points, US technology stocks soar

The US Federal Reserve announced on July 27 that it raised the interest rate by 75 basis points and raised the target rate for the federal funds to 2.25%-2.5%. This is the fourth time this year that the Federal Reserve has raised interest rates by 75 percentage points.

The Federal Reserve issued a statement Tuesday after a two-day monetary policy meeting, saying inflation remains high due to supply-demand imbalances caused by the coronavirus, higher energy prices, and broader price pressures; Russia, Ukraine Conflicts and related events have added to inflationary pressures. The committee is "very concerned about the dangers of inflation" and will continue to slash its balance sheet.

In a post-meeting press conference, Federal Reserve Chairman Jerome Powell said it might be an opportune time for the Federal Reserve to look for "convincing" signs of inflation and to continue raising interest rates in the coming months . In June, when the Federal Reserve announced a 75 basis point rate hike for the first time in 28 years, Powell said that raising rates by 75 basis points was very rare and not frequent.

Affected by this, the three major U.S. stock indexes all rose at the close on the 27th: Dow, Nasdaq, S&P 500, Nasdaq rose 1.37%, 4.06% and 2.62% respectively; Google rose 7%, Tesla, Meta, Microsoft, Amazon, more than 5%, Apple more than 3%; stocks of popular Chinese companies were mixed, Bilibili rose 4.5%, NetEase and Alibaba rose 1%, Xiaopeng, Weilai 1.7%, Ideal 0.4% , Jingdong 0.6%, Pinduoduo 0.3%, Daily Youxian 5.8%. (Original source: Xinhua News Agency reporter: Xiong Maoling, 36氪)

The Fed raised interest rates by 75 basis points, which was predicted by the media in June, and now the Fed has rounded up the forecast. This further reflects that the US economy is on the verge of a major downturn, and the Fed is trying to pull back from the brink with strong policy. But even if the U.S. economy declines, the dollar economy will not collapse. After all, the U.S. dollar is a high-credit currency, and the century economy is still a "dollar economy." No matter which country it is, it is still out of reach if it wants to shake the U.S. dollar as the world currency. Affected by the Fed's interest rate hike, U.S. stocks rose sharply, and technology stocks took the lead. The U.S. stock market was activated again, and Chinese stocks benefited. But whether the U.S. economy can recover or whether the U.S. stock market can end the "bear market" is hard to say. Some viewers will say, "Let the U.S. economy collapse, and the U.S. stock market will be destroyed, so that China can become the leader." Although China is the second largest economy in the world, China's currency status is still very low, and we are not even as good as the Japanese yen. International credit status, let alone replacing the US dollar, China's monetary economy still has a long way to go.

These are today's three technology news, I hope you like it.

These are today's three technology news, I hope you like it.

— END —

52RD

52RD will continue to provide information in the fields of technology such as smartphones, smart cars, semiconductors, cameras, etc., and is committed to creating a communication platform for engineers.

1076 original content

the public

Looking forward to your likes, watching and sharing ~