(The 4th Hardcore China Core kicks off! Scan the code to participate in the evaluation immediately!)

Reuters reported on July 28 that the U.S. Senate voted 64 to 33 on Wednesday, Eastern Time, to finally pass a chip bill that hopes to improve the United States' competitiveness in semiconductors and advanced technology.

It is reported that the bill, known as "CHIPS-plus," will provide about $52 billion in subsidies and other incentives for the U.S. semiconductor industry, as well as a 25% tax credit for those chip companies that build factories in the United States. The credit is estimated to be worth about $24 billion.

There is a very targeted content in the bill. The United States has given a multiple-choice question in the field of advanced semiconductor manufacturing.

For the global semiconductor giants, in the next 10 years, between the US and the Chinese market, they may have to "choose one of the two".

So we also see that many media directly give a simple and amazing title.

"The United States wants to lock China's high-end chips for 10 years."

However, if we take a broader view, we will find that the competition in the global chip industry is becoming more and more fierce.

The chip cycle is quietly changing

Chips, despite being a high-tech industry, are always very cyclical.

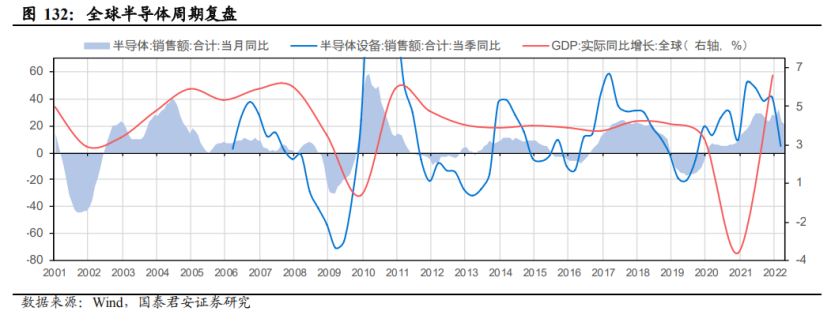

With the fluctuation of supply and demand and the iteration of technology, the prosperity of the chip industry generally has a fluctuation cycle of about 4 years.

From the above figure, we can see that a wave of chip boom cycle starting from 2019 has come to an end.

In the first half of 2022, sales of semiconductor equipment have fallen off a cliff, and sales of semiconductors have also shown signs of peaking.

The reason is that on the one hand, industries such as consumer electronics are saturated, and on the other hand, the demand side is weak in the global economic environment.

We can see that there is more and more news about the chip industry recently.

According to surging news reports, a Taiwanese media reported that TSMC, which has been in high production capacity, suffered orders from three major customers. Apple, AMD and Nvidia, the three major first-tier manufacturers, proposed to TSMC to reduce orders to deal with the uncertainty of the next consumer electronics demand.

Not only that, SMIC has also encountered some consumer electronics customers who cut orders, and some process nodes have loosened up and are looking for new customers to fill positions.

The Financial Associated Press' report also pointed out that executives from many different fields, including Hyundai Motor, Nokia, and home appliance maker Electrolux, have all released the same signal: the "lack of core" problem that had seriously plagued them last year, has now eased.

Market data shows that as of July, the price of light-emitting chips has dropped by about 20% to 30% year-on-year, and the price of driver chips has dropped by about 40%. And memory chips, analog chips and other varieties have also declined to varying degrees.

Although the outbreak of new energy vehicles has kept automotive-grade chips in the boom range, the general trend of the industry is still unstoppable.

"Chopping orders" has intensified and "lack of cores" has ended, which represents a double decline in price and demand, and also means a downturn in the industry cycle.

When a cyclical industry is on a downward slope, it is often the best opportunity to increase investment to improve competitiveness, thereby eating up the share of competitors after the industry picks up.

As a result, we have seen new developments in the US chip bill at this time.

Chip bill just for competition

The chip bill introduced by the United States this time has several core contents.

1) The plan is to allocate about 52 billion US dollars in 5 years, and 240/70/63/61/6.8 billion US dollars in 22-26 years respectively.

2) A four-year 25% tax break to encourage companies to build factories in the United States is estimated to be worth around $24 billion.

3) If the company invests in semiconductor manufacturing in mainland China, the company will not be able to obtain this subsidy.

4) Once a company obtains US subsidies and establishes a factory in the US, it cannot expand its investment in China's advanced process chips within 10 years, but there are no restrictions on mature processes.

The generous policy stimulus is aimed at leading chip companies with the ability to build factories in the United States, such as Samsung, TSMC, Infineon, STMicroelectronics and so on.

The "choose one of two" clause with such a clear target shows that the US is no longer covering up the market in order to seize the market.

According to U.S. reports, chip shortages have cost the U.S. economy $240 billion in 2021.

This also seems to be the decision made by the United States after a painful experience.

Another major reason why the bill is finally expected to be passed after two years of intense debate is that the US mid-term elections are approaching, and the $52 billion chip bill will undoubtedly help Democrats gain support for domestic manufacturing.

However, like the previous tariff issues with thunder and rain, these bills are all pawns for Biden to win votes, but it remains to be seen what the outcome will be.

In the middle of last week, Biden said he was on track to have a call between the Chinese and US leaders within 10 days. However, Biden just got the new crown, and I don’t know if the call can be carried out as scheduled.

It is believed that during the call, the two sides will communicate on key issues such as tariffs and the chip bill. It is also worth paying attention to the information transmitted by all parties after the call.

But in any case, the US chip bill further shows the development trend of "de-globalization" in the chip industry. The pressure has come to my country's chip companies.

Competition may be fiercer than thought

In fact, not only the United States, but also many countries and regions around the world that attach importance to chips are all thinking about the chip market.

In February this year, the European Commission announced the European Chip Act. It plans to invest 43 billion euros, aiming to increase the global share of European chip supply to 20%.

The main contents include the European chip initiative, the new framework to ensure supply security, and the EU-level coordination mechanism.

At present, Intel has announced that it will build 4 factories in Europe, and companies such as TSMC have also indicated that they will find suitable factories in Europe.

At the end of last year, Japan announced the rhetoric of investing 10 trillion yen in the next ten years to achieve mass production of the 2nm process.

In June this year, Japan has approved TSMC's fab plan and will provide subsidies of up to 476 billion yen (about 24 billion yuan).

South Korea is also moving frequently. When Biden went to Asia, Samsung proposed a huge investment plan of 450 trillion won (about 2.37 trillion yuan).

Recently, South Korea announced the "Semiconductor Superpower Strategy", which plans to guide companies to complete 340 trillion won (about 1.75 trillion yuan) in semiconductor investment by 2026.

Even India has been calling on semiconductor companies recently to provide subsidies to attract factories.

Every country has hundreds of billions or trillions of funds, and the volume of this investment is astonishing.

In the past few years, my country has made a lot of efforts in the replacement of domestic chips, so that everyone has a lot of confidence in their own chips.

However, according to data from IC Insights, a semiconductor analysis agency, the chip self-sufficiency rate in mainland China in 2021 is 16.7%.

There is clearly still a lot of room for improvement.

Not long ago, when we talked about the hegemony of the US dollar, many friends left a message saying that breakthroughs in technology are the key.

So at this point, we can't help but ask questions.

Facing a new round of competition in the chip field, are we ready?

(Disclaimer: This article is an objective analysis made by Ye Tan Finance based on public information, and does not constitute investment advice. Please do not use this as an investment basis.)

- END -

This article is reproduced from the WeChat public account Yetan Finance and Economics. The content is the author's independent point of view. It is for communication and learning purposes only, and does not represent the position of Master Core. If you have any questions, please contact us at [email protected].

▼ Wonderful Review of Past Issues ▼

Just now, a magnitude 7.0 earthquake hit the Philippines! Semiconductor supply chain may be affected

Chip companies should start to be wary of the death of the C round

What is Intel's intention to steal TSMC's major customers?

The pit that Tencent Ali stepped on, Byte jumped into it again

Excess or shortage? List of latest shipment dates for Q3 chips in 2022

Perspective on TSMC: How the super engineering of chip foundry rises from the ground up

Heavy! In the first half of 2022, the new policy of my country's semiconductor industry was released