Column introduction

In web3: a game of concepts , we discussed how having "ownable" at the heart of the new web3 vision is actually a ridiculous play on words that defies common sense. Because "possession" itself is an ideology that relies on human society, attempts to "technicalize" and "objectify" ideology are doomed to be fragile.

In this article, we will further illustrate that such attempts are not only fragile, but also dangerous. We will present structurally how the specter of capitalism creeps into the cloak of web3 technologism. And how this combination of technology and capitalism finally formed a unique and familiar "cyber capitalism" for human beings.

Author |Guo

Haiwei Email |[email protected]

To define bourgeois property is nothing more than a description of all the social relations of bourgeois production - Karl Marx

Cyber Rights and the Birth of Whales

-

Based on the above three attributes, we can make up an investment case in the web3 scenario:

-

We can think about a second example:

Tokenism and Potential Human Alienation

-

1.0 period: The blockchain currency represented by Bitcoin is almost an asset born purely for this system, and it was born almost at the same time as blockchain technology;

-

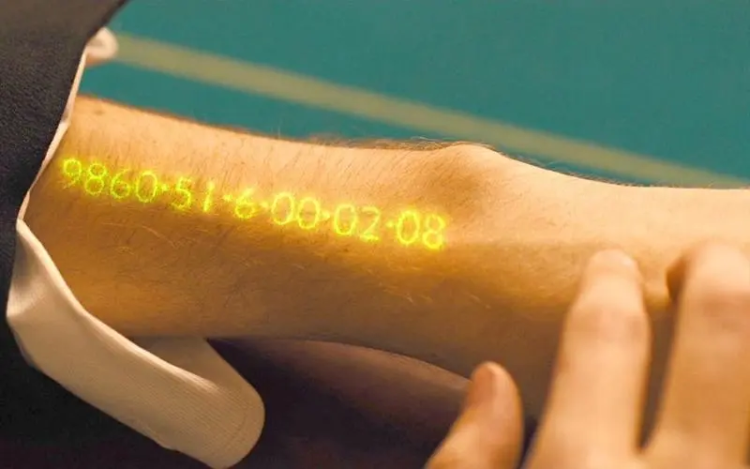

2.0 period: The content assets represented by NFT, the "on-chain" of books, audio, video and paintings.

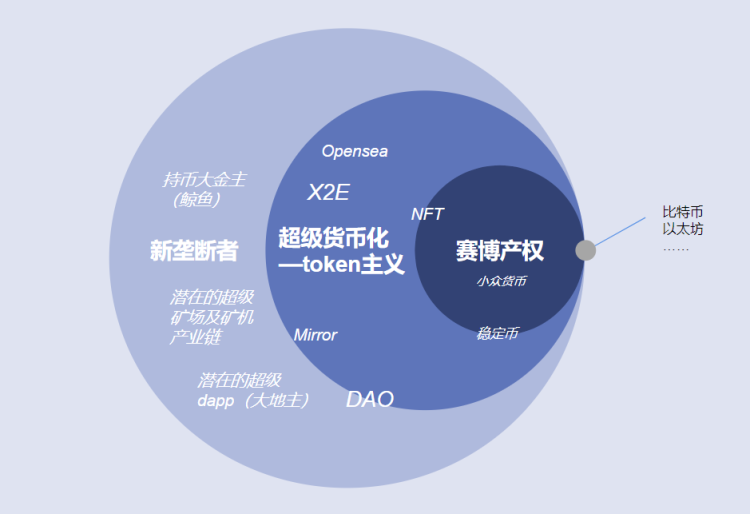

super monopoly capitalism

-

货币垄断(如上所述)

-

矿机和底层架构

-

场景应用(Dapp)

-

链的实控基金有大量币,他们需要有人来做大蛋糕,因此会拿币去吸引大量Dapp;

-

而开发者如果足够成功,它会下场自己造一个链或者发一个币(比如Solana是由加密货币交易所 FTX 创始人创立的)

-

DAO直接绕过这一切,让全世界开发者联合起来,自己玩自己的币和生态;

-

此外还有一些与web2逻辑类似的风险投资,同时链接平台和开发者,两头都喝一碗汤;